What is a Condo Budget?

Nov 12, 2023

A condominium budget will determine a condo apartment’s monthly common charges

It’s critical to analyze a condo budget before signing a purchase contract in NYC. Many first time home buyers rely exclusively on their lawyers to scrutinize the condo budget as part of the lawyer’s legal and financial due diligence. However, since you’ll be the one paying common charges in the future, it’s best to take a look at the condo budget yourself to make sure its anticipated income and expenses are both reasonable and realistic.

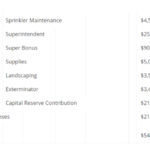

What does a current condo operating budget look like?

This is an example of a previous year’s annual operating budget for a condominium in New York City. Home buyers should carefully scrutinize the condo budget to make sure that expenses have been reasonable in the prior year’s operating budget.

You’ll want to scrutinize the charges incurred in the last operating year to make sure that the condo board isn’t being negligent in getting multiple quotes and making a reasonable effort to keep costs low. For example, an accountant shouldn’t cost over $5,000 depending on the scope of work. The building management company’s fee shouldn’t be in excess of 5 or 10% of the building’s total revenue from common charges.

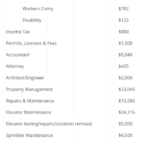

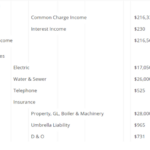

What does a projected condo operating budget look like?

This is an example of a forward operating condo budget for the same NYC condominium building for the current year. Home buyers should thoroughly compare the anticipated budget with the prior year’s budget to make sure costs have not increased dramatically. If costs have increased, it is an opportunity to determine whether the rate of increase is reasonable and in line with inflation.

A quick way to tell if common charges have increased is to see whether the revenue line item titled “Common Charge Income” has increased year over year. You can also see whether the building management company’s fee has increased. If the building management company’s fee has increased dramatically, it could either be because their fee has been the same for many years and this is a one time step up, or it could be a sign of a weak board that is not bothering to push back on fee increases.

Save thousands on your purchase with a discreet buyer closing credit without disrupting your deal or upsetting the other party. After all, what’s the point of a sweet closing gift if you don’t close?

Are Operating Budgets for Condo New Developments Realistic?

Because new development condominiums do not have any operating history, you’ll be relying exclusively on the projections of the developer when it comes to the condo budget. However, it’s important to understand that sponsors are keen to make the carrying cost of their units appear low to make them more appealing for buyers.

Therefore, an inexperienced buyer’s agent will be unlikely to point out that you should comb through the projected condo budget to make sure that the anticipated expenses are not artificially low. For example, it’s quite common for sponsors of smaller new development buildings in Brooklyn to claim that in the condo budget that there will be zero cost for a superintendent and there will be no building management fee because the building will be “self-managed.” However, this is deceptive because even if the owners choose not to hire a building management company in the future, they’ll still very likely need to hire a part time superintendent to help with maintenance and upkeep. It’s quite funny that the sponsor has decided to assume that the future owners will all be working for free as janitors and superintendents for their building! What a clever way to keep the common charges being marketed low!

What are Condo Budget Reserve Requirements in NYC?

Fannie Mae and Freddie Mac have tightened rules on reserve requirements for condo associations after the Great Financial Crisis of 2008. In order for a bank’s mortgage to be “conforming” and eligible for re-sale to Fannie Mae and Freddie Mac, a condo budget must set aside 10% of its yearly revenue to go to its reserve fund.

However, given that the average home sale price in New York City is $2 million, whether a loan is conforming or not may not matter for most New Yorkers. That’s because in order for a mortgage to be conforming, the size of the loan must be $424,100 or under as of 2017. As a result, it may not matter to most condominium buildings in New York because most buyers will be getting non-conforming, “jumbo” loans when they buy. This will be a relief for many

NYC condo boards because everyone would prefer to keep monthly charges low, and setting aside 10% each year for the reserve fund may seem superfluous as special assessments are charged anyway if there is a big project that needs to be paid for.

Make sure the building has its finances in order

After your offer is accepted, a good real estate attorney will conduct a thorough analysis of your prospective building’s financial situation. (Remember, we mean a good attorney; if you pick one unfamiliar with NYC real estate, or who runs an assembly-line chop-shop practice, or who receives a steady stream of referrals from someone who stands to gain from your sale–such as a broker or developer–your attorney may not give this critical process the attention it needs).

Some things to keep in mind: If a building hasn’t raised its monthly charges in years, this is likely a sign of bad management in that important projects are probably being deferred.

Similarly, while some higher-end buildings make a practice of “running lean” and levying assessments for emergencies and improvement projects, a reserve fund of less than 3 months may mean this building is struggling.