Mortgage Obstacles and Options for Minorities by Victoria Alexander

Feb 04, 2020 minorities home sales,mortgage advice,mortgage advice for minorites,mortgage option minorites,real estate advice,tommi edwards

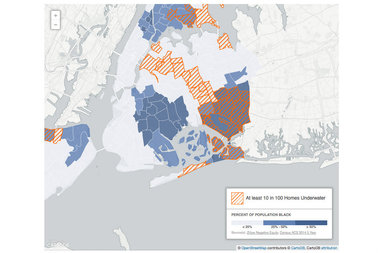

I recently read an article on DNA Info that stated 10% of Blacks homeowners in Queens, specifically Jamaica, are underwater on their mortgages.

A policy analyst at the Center for New York City Neighborhoods by the name of Leo Goldberg was quoted saying, “for home-owners who bought in the early 2000’s, white home values have recovered while black home-owners have lost net wealth in that time.” Goldberg credits this differentiation to home values in Jamaica being lower than what they were before the recession.

According to the article, many of the people who are currently underwater on their mortgages had either taken out subprime loans, had deferred balances or balloon payments. All of which prevents a person from ever accumulating equity on their properties.

The article draws a clear contrast between white and black mortgage owners which struck me as apparent race and socioeconomic issues. It made me think more about the role race plays when it comes to the home buying process.

It is known that many minority groups aren’t equipped with the financial resources to buy a home. Additionally, financial literacy is not a concept that many people living in financial distress understand. With that said, it is important for people to know their options and have a concrete understanding as to what they are signing up for when they take out a loan.

On an encouraging note, there are so many great programs and financing options available, such as NACA and FHA loans, that are geared towards those who may not be able to experience home ownership without the assistance of said programs. It is always recommended to enlist the services of knowledgeable and experienced real estate and mortgage professionals beforehand.